As expected, the Bank of Canada Wednesday morning cut its benchmark overnight rate by 25 basis points to 4.75%.

The move was anticipated by most economists as policymakers in Canada had previously signaled satisfaction with the direction of inflation alongside some concern about slowing economic growth.

“[It is] reasonable to expect further cuts to our policy interest rate” if inflation continues lower, said BoC Governor Tiff Macklem in prepared remarks following the decision.

Advertisement

Advertisement

At press time, bitcoin (BTC) was little-changed following the news, trading at $70,500.

With its action today, the BoC becomes the first of the G-7 central banks to begin what’s expected to be a cycle of easier monetary policy after a multi-year battle to cool inflation. Economists are expecting the European Central Bank to become the second of the major central banks to ease at its meeting tomorrow.

And though some members of the U.S. Federal Reserve have recently suggested that bank may hold off on any rate cuts for all of 2024, recent economic data have revealed slowdowns in both economic growth and inflation.Benchmark Traders currently have priced in a near-60% chance of a rate cut either prior to or at the Fed’s September meeting, according to CME FedWatch.

Other things being equal, tighter monetary policy is often a headwind for risk assets – bitcoin among them – as higher rates boost competition for investor capital. With a cycle of lower interest rates across Western economies seemingly at hand, bitcoin bulls might soon have their sights set on the crypto’s all-time high from March above $73,500.

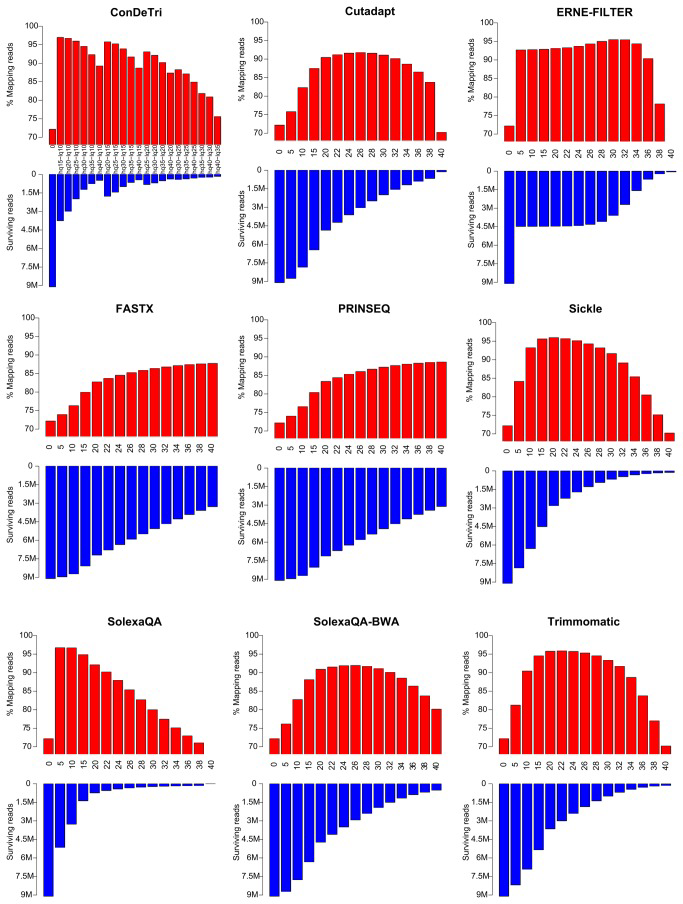

Trimming benchmarks are used to evaluate the performance of software tools designed to clean and optimize data, particularly in the field of next-generation sequencing (NGS).

Here’s a breakdown of what trimming benchmarks assess:

- Accuracy: How effectively does the tool remove adapter sequences and low-quality reads from the data?

- Speed: How fast can the tool process large datasets?

- Resource Usage: How much memory and processing power does the tool require?

- Customization: Does the tool offer flexibility in terms of user-defined parameters for trimming?

Here are some resources you might find helpful:

- Benchmarking software tools for trimming adapters…: This research paper discusses adapter trimming tools and how they are benchmarked [1].

- boulund/adapter_benchmark: This GitHub repository provides a framework for benchmarking adapter and quality trimming tools

Based on my search results, “boulund/adapter_benchmark” appears to be a GitHub repository related to benchmarking adapter and quality trimming tools used in bioinformatics. Here’s what I found:

- Repository Name: boulund/adapter_benchmark

- Platform: GitHub

- Possible Content: This repository likely contains code and data for benchmarking tools used to process sequencing data in bioinformatics. These tools might help remove adapter sequences (artificial sequences introduced during library preparation) and improve the quality of sequencing reads.

Here’s why this is relevant in bioinformatics:

- Next-Generation Sequencing (NGS): NGS technologies generate massive amounts of data, often containing adapter sequences that need to be removed for accurate analysis.

- Adapter Trimming: Adapter trimming tools identify and remove these adapter sequences from the raw sequencing reads, ensuring only the biological sequences of interest are analyzed.

- Benchmarking Importance: Comparing the performance of different adapter trimming tools helps researchers choose the most accurate and efficient tool for their specific needs.

Unfortunately, I cannot directly access private repositories on GitHub. If the repository is public, I could potentially provide more details about the specific tools benchmarked and the functionalities of the code.

Here are some ways to learn more about boulund/adapter_benchmark:

- Search for Documentation: If the repository is public, there might be a README file or other documentation explaining the purpose of the code and data.

- Look for Collaborators: Check the list of collaborators on the repository. You might be able to find contact information for them and inquire about the project.

- Explore Related Work: Search for publications or research papers that mention “boulund adapter benchmark” or similar keywords. These resources might provide context and details about the tools and methods used.

By following these suggestions, you can hopefully glean more information about the boulund/adapter_benchmark repository and its role in bioinformatics research.

- Read trimming and filtering benchmarking: This research explores performance metrics for read trimming tools [3].

A monetary easing cycle is a series of actions taken by a central bank, like the Federal Reserve in the US, to stimulate economic growth. It’s the opposite of a tightening cycle. Here’s how it works:

Lowering Interest Rates:

- The central bank’s main tool is lowering the federal funds rate. This is the rate at which banks lend reserves to each other overnight. When it’s lower, borrowing becomes cheaper for everyone, including businesses and consumers.

Increasing Money Supply:

- Another tactic is quantitative easing (QE). Here, the central bank buys government bonds and other securities from banks. This injects new money into the economy and increases the money supply. With more money circulating, interest rates tend to fall further.

Goals of Easing:

- The main goals of a monetary easing cycle are to:

- Boost economic growth by encouraging borrowing and investment.

- Increase inflation to a healthy level (usually around 2%). This can help businesses and consumers feel more confident spending money, which stimulates the economy.

Potential Risks:

- While easing can be helpful, there are potential risks:

- Asset bubbles: Low interest rates can lead to inflated asset prices like stocks and real estate.

- Excessive inflation: If the central bank eases too much, it can cause inflation to spiral out of control, eroding purchasing power.

Current Situation (as of June 2024):

- It’s important to note that economic conditions are constantly evolving.

- In recent years, many central banks have been raising interest rates to combat inflation.

- Whether or not we’re entering a monetary easing cycle depends on how inflation and economic growth develop in the coming months.

Here are some resources for further reading:

The Fed – Lessons from Past Monetary Easing Cycles

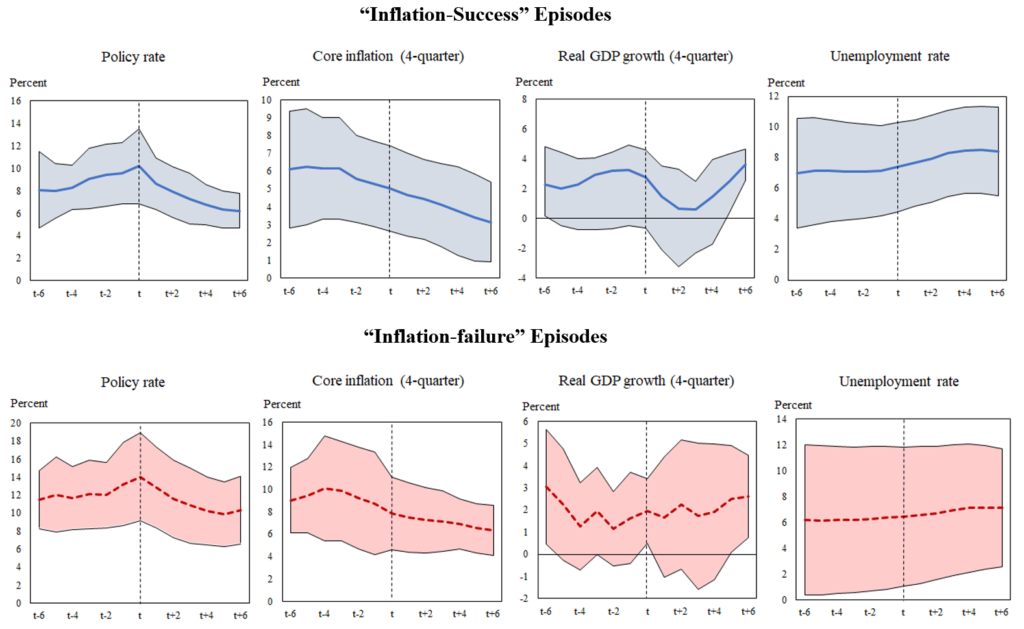

This is a very interesting topic! The Federal Reserve (https://www.federalreserve.gov/) has a great resource available online titled “The Fed – Lessons from Past Monetary Easing Cycles” that dives into the analysis of past easing periods. Here’s a summary of the key takeaways from that document:

Effectiveness in Combating Recession:

- Generally Successful: The report finds that past episodes of monetary easing were generally successful in mitigating recessions and promoting economic recovery. Lowering interest rates and increasing the money supply stimulated borrowing and investment, fostering economic growth and job creation.

Challenges of Inflation Control:

- Mixed Results: The report acknowledges mixed results regarding inflation control. While some easing cycles effectively countered deflationary pressures (falling prices), others contributed to later inflationary periods.

Importance of Timing:

- Early Action Preferred: The report emphasizes the importance of central banks acting early in tightening monetary policy after easing cycles. This helps prevent inflation from becoming entrenched and allows for a smoother transition back to a neutral stance.

Imperfect Science:

- Uncertainty and Lags: The report acknowledges the inherent uncertainties involved in monetary policy. The impact of easing actions can take time to be fully realized, making it a balancing act to avoid overstimulating the economy.

Key Considerations:

- Tailoring Policies: The effectiveness of monetary easing depends on various factors like the severity of the recession and the underlying economic conditions. Central banks need to tailor their policies accordingly.

- Financial Stability: Monetary easing can sometimes contribute to asset price bubbles. The report highlights the importance of considering financial stability risks alongside economic growth objectives.

- Transparency and Communication: Clear communication by central banks regarding their monetary policy decisions and future expectations can help manage market expectations and maintain confidence in the economy.

Overall, the Federal Reserve’s analysis suggests that monetary easing can be a powerful tool for promoting economic recovery. However, its effectiveness depends on various factors, and careful consideration is needed to manage potential risks and ensure a smooth transition back to neutral monetary policy.

By referring to the original Federal Reserve document and exploring other resources on this topic, you can gain a deeper understanding of the complexities and lessons learned from past monetary easing cycles.

Tight Monetary Policy: Definition, Mechanisms, and Benefits

Tight monetary policy, also known as contractionary monetary policy, refers to actions taken by a central bank, like the Federal Reserve in the US, to slow down economic growth and curb inflation. Here’s a breakdown of its definition, how it works, and its potential benefits:

Definition:

Tight monetary policy involves actions that reduce the money supply and raise interest rates in an economy. This makes it more expensive for businesses and consumers to borrow money, leading to decreased spending and investment.

Mechanisms Used:

- Raising Interest Rates: The central bank increases the federal funds rate, which is the rate banks charge each other for overnight loans. This increase ripples through the banking system, impacting interest rates on loans for businesses and individuals. Higher borrowing costs discourage borrowing and spending.

- Open Market Operations: The central bank sells government bonds in the open market. This reduces the money supply in circulation, as investors use their existing cash to buy the bonds. A lower money supply makes it harder to obtain loans, further tightening credit.

- Reserve Requirements: The central bank increases the reserve requirement, which is the percentage of deposits banks must hold as reserves instead of lending them out. This takes more money out of circulation, limiting the lending capacity of banks.

Benefits of Tight Monetary Policy:

- Controlling Inflation: The primary goal of tight monetary policy is to combat inflation. By reducing the money supply and raising borrowing costs, it dampens economic activity and reduces demand for goods and services. This can help slow down price increases and bring inflation back to a target level.

- Promoting Financial Stability: Tight monetary policy can help prevent financial bubbles and asset price inflation. By making borrowing more expensive, it discourages excessive speculation and risky investments, potentially promoting a more stable financial system.

- Balancing Economic Growth: While slowing economic growth is the intended effect, tight monetary policy can sometimes be necessary to prevent overheating. In situations with rapid economic growth, inflation can spiral out of control. Tightening the money supply can help moderate growth and maintain it at a sustainable pace.

Important Considerations:

- Impact on Economic Activity: Tight monetary policy can also lead to slower economic growth, decreased investment, and potentially higher unemployment. It’s a balancing act for central banks to control inflation without hindering economic progress.

- Time Lags: The effects of tight monetary policy can take time to be fully realized. It might take several months for changes in interest rates or the money supply to translate into lower inflation or slower economic growth.

- External Factors: Global economic conditions and external factors can also influence the effectiveness of tight monetary policy.

Overall, tight monetary policy is a tool central banks use to manage inflation and maintain economic stability. However, it’s a balancing act that needs to be carefully considered to avoid hindering economic growth.