Economics can help us answer these questions. Below, we’ve provided links to short articles that illustrate what economics is and how it connects to our everyday lives.

Economics can be defined in a few different ways. It’s the study of scarcity, the study of how people use resources and respond to incentives, or the study of decision-making. It often involves topics like wealth and finance, but it’s not all about money. Economics ranges from the very small to the very large.

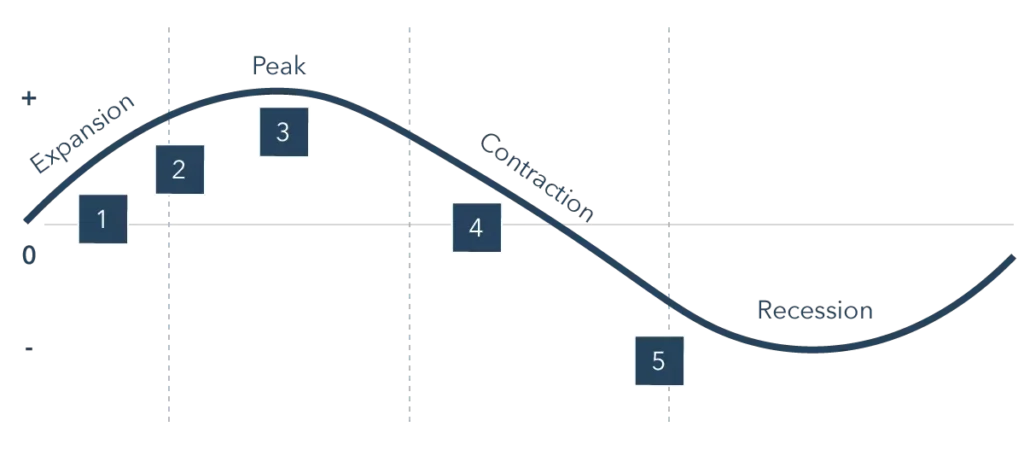

A recession is a significant decline in economic activity that lasts for a prolonged period of time, typically months or even years. It’s essentially a downturn in the overall health of an economy.

In recent months, there has been increasing chatter about the possibility of the United States economy entering a recession, with several indicators flashing red.

In this line, analysis shared on X on June 1 by investment research platform Game of Trade offered a deep dive into the intricacies of economic indicators suggesting a potential recession on the horizon, with housing market trends and unemployment rates playing pivotal roles.

According to the analysis, housing is a crucial leading indicator for recessions, with rising unemployment being the most significant characteristic of economic downturns.

The platform acknowledged that historically, the gap between recessions averages about 5.5 years, indicating that the next recession could be expected as late as 2026 if this pattern holds.

However, the analysis pointed out that economic cycles are not purely about average timing. External shocks such as oil crises, pandemics, and market crashes have historically triggered recessions, making them difficult to predict.

Weakening house markets

Despite this, one reliable precursor remains a weakening housing market. Data tracking two-year housing sales reveals that when housing markets falter, a recession often follows with a slight delay.

Game of Trade finding also suggested a strong correlation between housing market trends and unemployment rates. By shifting housing market data forward by 18 months, a near-perfect correlation with upcoming recessions and recoveries emerges.

“This happens because housing is highly sensitive to interest rates. When the Fed hikes rates, housing feels the impact first. Whereas, the rest of the economy takes more time to feel the lagging effects of rising rates,” the platform noted.

Additionally, the insights observed that the unemployment rate takes time to bottom out during all recessions and then rise. The only exception to this pattern was in 2020 when the pandemic caused a massive and immediate economic shock.

At the moment, the unemployment rate has been rising since April 2023, marking about a year of increase. Historical comparisons show that it took about one year of rising unemployment before the recessions in 2000 and 2006 and approximately 1.5 years in 1989.

Next recession timeline

Therefore, the assessment noted that if the housing market’s predictions hold true, a recession could occur by late 2024. However, the historically low unemployment rate might delay its onset.

Additionally, significant government spending in recent years could further postpone the next recession. Such heavy spending, unseen since the 1960s, delayed the recession until spending levels normalized back then, potentially mirroring the current economic landscape.

Defining a Recession

President Truman’s point aside, one common definition of a recession is two consecutive quarters of decline in the GDP. The National Bureau of Economic Research, which dates recessions in the U.S., defines one as “a significant decline in economic activity spread across the economy, lasting more than a few months.” As long as all of these conditions are met to some degree, the NBER is willing to treat them as interchangeable. For example, the severity and pervasiveness of the COVID-19 downturn in the spring of 2020 led the NBER to call it a recession, albeit one that officially lasted just two months.

By any definition, recessions cause job losses and a contraction in economic output as consumer spending and business investment slump.

Recession Impact on Small Businesses

U.S. small businesses have impressive numbers in the aggregate. Defined expansively as those with fewer than 500 employees, they accounted for 43.5% of the U.S. GDP in 2014, though that was down from 48% in 1998.2 Those with fewer than 100 employees still accounted for 30% of U.S. wages and 35% of employment from 2012 through 2016.

Those figures shouldn’t obscure the fact that most small businesses are tiny. Nearly 40% had revenue below $100,000, and more than 70% generated sales below $500,000, according to Internal Revenue Service (IRS) statistics from 2013. Just 20% of the 29.6 million small businesses counted by the U.S. Census Bureau were employers.

This lack of scale leaves the vast majority of small businesses with less of a financial cushion, market power, and leverage within their industry to weather the tough times a recession brings.

Lenders know that. They are likely to be less enthused about lending to a business without significant cash reserves and capital assets that can serve as collateral during periods of heightened uncertainty and business risk associated with recessions.

Unlike publicly listed companies, small businesses typically can’t raise funds by selling stock in a secondary offering or issuing bonds. In contrast with large employers in high-value industries, failing small businesses also can’t typically lobby the government for help.

As a result, small businesses are particularly vulnerable to spikes of Chapter 11 bankruptcies associated with past recessions. The exception was the COVID-19 recession when pandemic relief measures widely available to employers of every size averted the expected wave of bankruptcies.

Small businesses tend to fare worse than large ones in a recession because they’re less able to withstand a drop in sales amid mounting economic uncertainty.

Recession Impact on Large Companies

Large companies aren’t immune to recessions. In 2020, 244 sought bankruptcy protection, the most since 2009; energy, retail and consumer services were the hardest hit sectors.

As the declines in revenue and profit show up on quarterly earnings reports, share prices may suffer deep declines, since bear markets often accompany a recession and may even precede it. If the profit slump is particularly steep, some companies may be forced to reduce or eliminate shareholder dividends.

Large companies do, however, have more ways than small businesses to combat the declines in revenue and earnings in a recession.

They may reduce hiring, impose a hiring freeze and suspend pay raises, resorting to layoffs to cut costs if all else fails. Companies may also cut capital spending and marketing, curtail research and development, and stop new product rollouts. Such cuts at large companies are likely to have ripple effects on their many employees and suppliers.

One study found that large companies that realize operational cost savings without cutting employees while making long-term strategic investments during a recession tend to outperform once the downturn ends.

Large companies, while seemingly more stable than smaller businesses, are not immune to the negative impacts of a recession. Here’s a closer look at how recessions can affect large corporations:

Reduced Revenue and Profits: Just like smaller businesses, large companies also experience a decline in sales as consumer spending tightens. This directly translates to lower revenue and ultimately, a significant drop in profits.

Cash Flow Concerns: Even with established cash reserves, large companies can face cash flow issues during a recession. Delayed payments from customers and a decrease in overall sales can disrupt smooth financial operations.

Investment Slowdown: Economic uncertainty leads to a more cautious approach. Large companies may postpone or scale back investments in new projects, research and development, or infrastructure upgrades. This can stifle innovation and hinder long-term growth prospects.

Job Losses and Hiring Freezes: While large companies might not resort to massive layoffs immediately, they may implement hiring freezes or workforce reductions through attrition. This can impact employee morale and potentially reduce the company’s ability to meet existing demands.

Supply Chain Disruptions: Global recessions can disrupt global supply chains, impacting large companies that rely on complex networks for raw materials and finished goods. This can lead to production delays, shortages, and increased costs.

Impact on Stock Prices: A decline in overall economic activity and corporate profits often leads to a decrease in stock prices. This can erode shareholder confidence and impact the company’s ability to raise capital.

However, large companies also have some advantages in weathering a recession:

- Financial Resources: Large companies typically have larger cash reserves and established credit lines, offering them a buffer during a downturn. This allows them to invest in maintaining operations while smaller businesses struggle.

- Diversification: Many large companies operate in multiple markets or have diverse product lines. This diversification can help mitigate the impact of a recession in one particular sector.

- Brand Recognition: Strong brand recognition and established customer loyalty can help large companies retain market share even during difficult economic times.

- Cost-Cutting Strategies: Large companies have the resources to implement sophisticated cost-cutting measures, such as renegotiating contracts with suppliers or streamlining operations.

Business Effects of a Recession

Many recession effects touch companies large and small. Below we look at some of the most common challenges businesses of any size face in a recession.

Slumping Sales

In a recession, nothing hurts a business quite so much as when the register stops ringing as often, or when orders slow to a trickle. During an economic contraction aggregate demand declines, translating into a drop in sales for most businesses.

Cyclical industries including manufacturing and energy tend to experience particularly sharp declines. Companies with high fixed costs like retailers and technology suppliers face a disproportionate hit to the bottom line as revenue declines.

Manufacturers may face bloated inventories, forcing them to slow output until demand recovers.

The souring of consumer demand lowers the expected returns on investment for advertising and marketing spending, prompting cuts in those budgets. That can lead to revenue slumps for media companies whether they publish, broadcast, or sell ads online.

Credit Impairment and Bankruptcy

One of the first effects recessions have on businesses is the tightening of credit conditions. Faced with a downturn of uncertain severity and duration, lenders turn more selective of the risks they are willing to underwrite.

A recession may bloat a company’s accounts receivable as liquidity issues impact consumers and businesses up and down the supply chain. Customers who owe the company money may be slower to make payments or fail to make them altogether. The company may, in turn, be forced to slow its own payments.

While large companies may be able to refinance their debt at a lower interest rate as the Federal Reserve lowers the federal funds rate in response to the downturn, most businesses face fixed debt service costs that must be met even as sales and profits slump. This is why past recessions have caused business bankruptcies to increase sharply.

The Chilling Grip of Recession: How Businesses are Affected

A recession throws a wrench into the well-oiled machine of any business. Here’s a breakdown of how recessions can negatively impact businesses of all sizes:

1. Reduced Demand and Sales: Consumer confidence plummets during recessions, leading to people spending less. Businesses experience a decline in demand for their products and services, resulting in lower sales figures.

2. Cash Flow Squeeze: With fewer sales, businesses face a cash flow crunch. They may struggle to pay bills, employees, and suppliers on time. This creates a domino effect, disrupting operations and hindering growth.

3. Layoffs and Hiring Freezes: To cut costs and stay afloat, businesses often resort to layoffs. This not only impacts employee morale but also reduces the company’s capacity to meet existing demand. Hiring freezes become the norm, hindering future expansion plans.

4. Difficulty Accessing Credit: Banks tighten their lending belts during recessions, making it harder for businesses to secure loans. Existing credit lines may be reduced, limiting access to working capital needed to operate.

5. Profit Slump and Increased Competition: As sales decline and costs remain high, profits take a significant hit. Businesses face increased competition from rivals vying for a shrinking market share. Price wars and aggressive marketing tactics become commonplace.

6. Disruptions in Supply Chains: Global recessions can disrupt supply chains, leading to shortages of raw materials and finished goods. This can cause production delays and increase costs for businesses.

7. Investment Slowdown: Businesses become more cautious and hesitant to invest in new equipment, technology, or expansion plans due to economic uncertainty. This can hinder innovation and long-term growth prospects.

8. Impact on Business Confidence: The overall economic gloom can dampen business confidence. Entrepreneurs may become hesitant to take risks or launch new ventures, further slowing economic activity.

Navigating the Storm: Strategies for Businesses During a Recession

While the effects of a recession can be harsh, there are ways for businesses to weather the storm. Here are some strategies to consider:

- Focus on Cost Reduction: Identify areas where costs can be trimmed without compromising quality. Renegotiate with suppliers, implement lean manufacturing practices, and find efficiencies in operations.

- Cash Flow Management: Prioritize collecting outstanding payments from customers and manage inventory levels effectively. Explore alternative financing options to maintain cash flow during slow periods.

- Diversification: Explore new markets or product lines to reduce dependence on a single customer base or product category. This can help mitigate risk and potential losses.

- Enhancing Customer Value: Focus on delivering exceptional customer service and value propositions to retain existing customers and attract new ones during challenging times.

- Investing in Innovation: While large-scale investments might be limited, focusing on cost-effective innovations and process improvements can help businesses stay ahead of the curve.

- Building Resilience: Develop a contingency plan to manage a potential recession. This includes maintaining healthy cash reserves, diversifying revenue streams, and having a flexible workforce strategy.

Employee Layoffs and Benefit Reductions

Businesses large and small may undertake layoffs to cut costs, especially if they need fewer workers to meet the reduced demand for their products and services. Productivity per employee may increase, but morale may suffer as workloads increase while pay gains slow or stop amid the risk of further layoffs.

Wages are sticky, meaning workers are reluctant to accept cuts in pay even if layoffs are the likeliest alternative. In a particularly prolonged and deep recession, however, labor and management may negotiate the cost concessions required to save the company and preserve jobs, including wage and benefit reductions.

If the company is a manufacturer, it may be forced to close plants and discontinue poorly performing brands, necessitating mass layoffs. Automobile manufacturers have done this in previous recessions, for example.

What Is a Recession?

A recession is a significant, widespread and prolonged contraction in economic activity. It is often commonly defined as two successive quarterly declines in GDP. The National Bureau of Economic Research uses a variety of employment, income, and consumption indicators to date U.S. recessions.

Here’s a breakdown of what a recession entails:

- Widespread Decline: A recession isn’t isolated to one industry or sector. It affects the entire economy, with a decrease in production of goods and services.

- Length of Time: While short-term dips are normal, a recession signifies a more extended period of weakness, usually lasting months or even exceeding a year.

- Impact on Key Indicators: Several factors point to a recession, including:

- Negative GDP Growth: Gross Domestic Product (GDP) is the total value of goods and services produced in a country. Negative GDP growth for a couple of quarters in a row is a typical sign of a recession.

- Rising Unemployment: As businesses cut back due to lower demand, unemployment tends to rise during recessions.

- Decreased Consumer Spending: Consumers tighten their belts and spend less when economic uncertainty prevails.

- Falling Retail Sales and Industrial Production: Businesses sell less, and factories produce fewer goods as the economy weakens.

- Causes of Recession: There isn’t a single trigger for a recession. It can be caused by various factors like financial crises, bursting economic bubbles, or external events like trade wars or pandemics.

- Government Response: Governments typically implement policies to counter recessions, such as lowering interest rates or increasing government spending to stimulate economic activity.

While recessions are a natural part of the economic cycle, they can have severe consequences for people and businesses. Understanding the signs of a recession can help individuals and businesses prepare for potential downturns.

What Are the Main Effects of a Recession on Businesses?

Recessions cause declines in sales that can spiral as the resulting layoffs further depress demand. Credit access tends to tighten amid rising economic uncertainty, while loan delinquencies and defaults increase alongside bankruptcies.

The Bottom Line: Preparing for Uncertain Times

While the possibility of a recession can’t be entirely ruled out, it’s also important to acknowledge the resilience of the global economy. By monitoring key indicators, policymakers and businesses can take steps to mitigate the impact of an economic downturn. Individuals can also prepare by building an emergency fund and reevaluating their spending habits.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!