What Is Cryptocurrency?

A cryptocurrency is a decentralized, digital store of value and medium of exchange. It’s not a currency with any physical tokens, like dollar bills, and it lacks any centralized governmental oversight.

Instead, cryptocurrency relies on encrypted, distributed ledgers—so-called blockchain technology—to record and verify all transactions. Think of blockchain ledgers as a constantly updated checkbook that tracks every transaction ever made in a given cryptocurrency.

Bitcoin was the first cryptocurrency, launched in 2009. Today there are thousands of others in circulation, including bitcoin cash, litecoin, ripple and dogecoin.

Table of Contents

How Is Cryptocurrency Taxed?

Crypto taxes are generally based on a 2014 IRS ruling that determined cryptocurrency should be treated as a capital asset, like stocks or bonds, rather than as currency, like dollars or euros. This decision has had major ramifications for people who own crypto, as it has opened them up to more complicated taxes.

The IRS may have chosen to tax crypto as a capital asset because of the way most people treat it, says Jeff Hoopes, an associate professor of accounting at the University of North Carolina and research director of the UNC Tax Center. “I assume [the IRS] decided this because most people hold crypto as an investment, and we tax the appreciation on capital assets held as an investment,” he says.

Capital assets are taxed whenever they are sold at a gain. If you hold your cryptocurrency for more than one year and sell it for more than you paid for it, you will incur capital gains taxes. If you hold it for one year or less and realize a gain, you’ll pay ordinary income taxes, which are taxed at higher rates than capital gains.

Let’s say you bought $20 worth of bitcoin and have held it for three years, as your investment rose in value to $200. If you decide to sell it, you’ll owe capital gains taxes on your gain of $180.

But if you bought $100 worth of bitcoin and it decreased in value over three years, to $20, you’d be selling at a capital loss. Though you’re not required to pay any taxes on capital losses, you could use the loss to offset other income up to $3,000 ($1,500 if married filing separately), to reduce your taxable income. You’d have the option of claiming a portion of the loss each year until you’ve exhausted the total amount.

If you received cryptocurrency as a form of wages, your employer will report it at fair market value on your W-2, “Wage and Tax Statement.” You’ll need to report the amount on your income tax return and pay ordinary income taxes on the amount received.

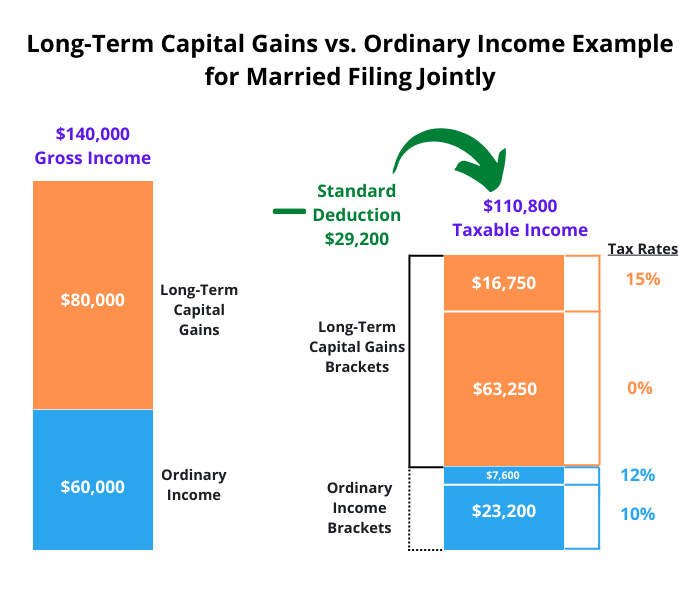

Capital Gains Tax Rates vs. Ordinary Income Tax Rates

Here’s the good thing about crypto and taxes: If you’re required to pay capital gain taxes, the tax rate will be smaller than your ordinary income tax rate.

For the 2023 tax year, the capital gains tax rates are 0%, 15%, and 20%. Capital gains tax rates apply if you sell your cryptocurrency after holding it beyond one year and get more than you paid for it.

However, if you sell your cryptocurrency at a gain but have held it for only a year or less, you’ll be taxed at your ordinary income tax rate, which is determined by your income and filing status. For 2023, ordinary tax rates could be as high as 37%.

Crypto tax rates for 2023

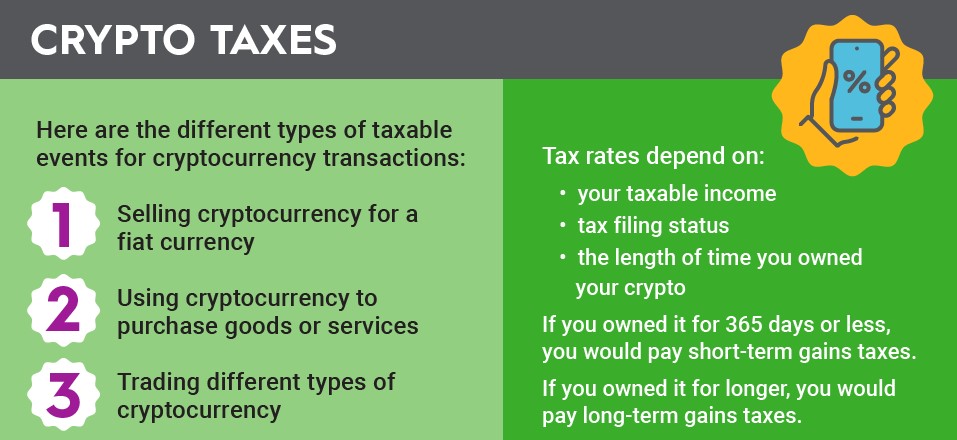

Cryptocurrency tax rates depend on your taxable income, tax filing status, and the length of time you owned your crypto before selling it. If you owned it for 365 days or less, you would pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, you would pay long-term gains taxes.

Here are the cryptocurrency tax rates on long-term gains for the 2023 tax year.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 0% | $0 to $44,625 | $0 to $89,250 | $0 to $59,750 |

| 15% | $44,626 to $492,300 | $89,251 to $553,850 | $59,751 to $523,050 |

| 20% | >$492,300 | >$553,850 | >$523,050 |

Short-term gains are taxed as ordinary income. Here are the crypto tax brackets on these short-term gains for the 2023 tax year:

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 | $15,701 to $59,850 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 | $59,851 to $95,350 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,351 to $182,100 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $578,100 |

| 37% | >$578,125 | >$693,750 | >$578,100 |

You can sell older coins first to pay the lower long-term gains tax rates. Imagine you’ve been buying Bitcoin (BTC -2.99%) regularly for the past two years, and now you’ve decided to sell some. If you sell Bitcoin you’ve had for over a year, it will be considered a long-term gain and you’ll pay a lower crypto tax rate on it.

Image source: Getty Images.

Crypto tax rates for 2024

Here are the long-term cryptocurrency tax rates that will apply when you file your 2024 tax return.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 0% | $0 to $47,025 | $0 to $94,050 | $0 to $63,000 |

| 15% | $47,026 to $518,900 | $94,051 to $583,750 | $63,001 to $551,350 |

| 20% | >$518,900 | >$583,750 | >$551,350 |

As previously noted, the IRS taxes short-term crypto gains as ordinary income. Here are the 2024 income tax rates that will apply to gains on crypto you held for 365 days or less.

| TAX RATE | SINGLE | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,701 to $609,350 |

| 37% | >$609,350 | >$731,200 | >$609,350 |

How to determine whether you owe crypto taxes

You owe crypto taxes if you spend your crypto and it has increased in value from when you bought it. Here are the different types of taxable events for cryptocurrency transactions:

- Selling cryptocurrency for a fiat currency

- Using cryptocurrency to purchase goods or services

- Trading different types of cryptocurrency

These are only taxable events if the value of your crypto has increased. To determine whether you owe crypto taxes, you need the cost basis, which is the total amount you paid to acquire your crypto. Then, you compare that to the sales price or proceeds when you used the crypto.

Let’s say you previously bought one Bitcoin for $20,000. Here are some examples of taxable events you could encounter:

- If you sell one Bitcoin for $50,000, you’d report $30,000 in gains.

- If you use one Bitcoin to purchase a $45,000 car, you’d report $25,000 in gains.

- If you trade one Bitcoin for $60,000 of another cryptocurrency, you’d report $40,000 in gains.

Trades between coins are where crypto taxes get complicated. A crypto trade is a taxable event. If you trade one cryptocurrency for another, you’re required to report any gains in U.S. dollars on your tax return.

Every time you trade cryptocurrencies, you need to keep track of your gains and losses in U.S. dollars so that you can accurately report them. If you’d rather keep it simple, cryptocurrency stocks could make tracking gains and losses simpler than buying and selling specific coins.

How Much Do I Owe in Crypto Taxes?

Whether you sell or earn cryptocurrency will determine how much you’ll owe in taxes.

When you sell crypto and have realized a gain on your investment, you may owe either normal income taxes or capital gains taxes, depending on how long you held the crypto. If you held it for a year or less, you’ll pay the higher, ordinary tax rates.

If you earn cryptocurrency by mining it, or receive it through a promotion or as payment for goods or services, it counts as regular taxable income taxed at your normal income tax rate.

In addition, if you hold on to cryptocurrency from these activities and either spend or sell it later for more than the value when you first received it, you’ll owe short- or long-term capital gains taxes on the profits, based on how long you held the crypto.

Do I Owe Taxes on Cryptocurrency?

Here are some questions to help determine whether you owe taxes on your cryptocurrency.

- Did you mine cryptocurrency? “Mining” crypto is when you use computers to solve complicated equations and record data on the blockchain. In exchange for this work, you may receive payment in new crypto tokens. You owe taxes on the fair market value of cryptocurrency you obtain by mining.

- Did you get crypto as a reward or an airdrop? If you receive cryptocurrency through a marketing promotion or an airdrop, it counts as taxable income.

- Did you receive payment for goods or services in cryptocurrency? If someone pays you crypto for goods or services rendered, the entire payment counts as taxable income, just as if they paid you in cash. Unlike a cash payment, though, your customer might also owe income taxes if their crypto provides them with greater value than they paid for it.

- Did you sell cryptocurrency to realize an investment gain? If you sell crypto for more than you paid for it, you owe tax on the gain as you would with stocks or mutual funds.

- Did you convert or exchange one crypto for another? When you convert or exchange crypto—swapping bitcoin for ethereum, for example—you owe taxes on any gains made in the transaction. If you purchased $400 worth of bitcoin and used it to buy $1,000 worth of ethereum, you’d owe taxes on $600 in realized profit, even though you’re just exchanging one crypto for another.

While this might seem like a lot to track, don’t take any shortcuts with your cryptocurrency taxes. You should even consider hiring a tax professional.

“Taxpayers are required to report their crypto transactions on their tax returns,” says Jon Feldhammer, tax partner at Baker Botts. “The IRS is cracking down on this.”

Learn more: https://gemini.google.com/app

Pros and Cons

Pros:

- Potential tax benefits: Just like stocks, crypto gains benefit from long-term capital gains rates, which can be much lower than ordinary income tax rates. You can also offset gains with losses to reduce your tax burden.

Cons:

- Complexity: Crypto transactions can be numerous and complicated, especially for frequent traders. Keeping good records is crucial to avoid tax headaches later.

- Reporting requirements: Even if you don’t receive a 1099 form for your crypto activity, you’re still responsible for reporting it to the tax authorities.

- Uncertainties: Crypto regulations are still evolving, so tax laws might change in the future.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!