Digital payment platform PayPal (NASDAQ: PYPL) is launching an advertising sales business leveraging its extensive user data.

The company plans to build this new business using the vast amounts of data generated from tracking purchases and spending behaviors of millions of consumers using its services, including the popular Venmo app.

Gurgavin Chandhoke, CEO at uINVST, highlighted the move on X (formerly Twitter):

To lead this new venture, PayPal has appointed Mark Grether, former head of Uber’s advertising business, as senior vice president and general manager of the newly-formed PayPal Ads division.

Grether will be responsible for developing new ad formats, overseeing sales, and hiring staff to build out the division. This move is part of PayPal’s strategy to create a robust advertising platform rooted in commerce and to strengthen the company’s consumer value proposition, as announced on May 28.

Central to this approach is its new advanced offers platform, launched in January. Leveraging artificial intelligence (AI), the platform scrutinizes nearly half a trillion dollars in transaction data to deliver personalized consumer insights and deals.

With advanced offers, merchants pay for performance — not impressions or clicks — potentially making PayPal an attractive ad partner in the crowded media network space.

PayPal is developing an advertising sales business built on its user data.

The payments giant would create this ad network using data from user purchases as well as wider spending patterns from the millions of people using PayPal and Venmo, the company announced Tuesday (May 28).

To make this happen PayPal has tapped Mark Grether, one-time head of Uber’s ad business, to oversee the project as senior vice president and general manager of its newly-created PayPal Ads division.

“PayPal’s long-standing relationships with millions of consumers and merchants make the company uniquely positioned to create an advertising platform that is rooted in commerce,” the company said in a news release.

“Grether will join the company to build an advertising business that will help make merchants smarter to sell more products and services effectively, as well as enable consumers to discover more of what they love.”

The advertising business will include PayPal advanced offers platform, an ad product that employs artificial intelligence (AI) and company data to help merchants offer PayPal users discounts and other personalized promotions.

However, Advanced Offers only charges advertisers when consumers make a purchase. Now, the company is aiming to sell ads to both its own customers and to so-called non-endemic advertisers, or companies that don’t sell products or services via PayPal.

“If you’re someone who’s buying products on the web, we know who is buying the products where, and we can leverage the data,” Grether told the WSJ Monday, adding that PayPal credit card customers would also give the company data from brick-and-mortar retailers.

The company’s most recent earnings report showed PayPal processing 6.5 billion payments by roughly 400 million customers in the first quarter. Total payment volumes climbed 14% to $403.9 billion during the quarter.

The WSJ notes that many companies have built or are starting to build ad networks powered by data from customers to target ads for outside marketers.

For example, Chase last month introduced Chase Media Solutions, which will let advertisers target Chase customers with discounts and deals related to their spending history.

As PYMNTS wrote at the time, retail media networks like this one “have become a fixture, as retail giants, including Walmart and Amazon, have capitalized on these networks to sell advertisements over the years.”

Home Depot’s recent enhancements to its own retail media network also spotlights the competitive landscape for marketers’ retail media ad budgets.

Setting Chase apart is the company’s claim to be the “only bank-led media platform of its kind,” giving brands direct access to its wide-ranging banking customer network.

Table of Contents

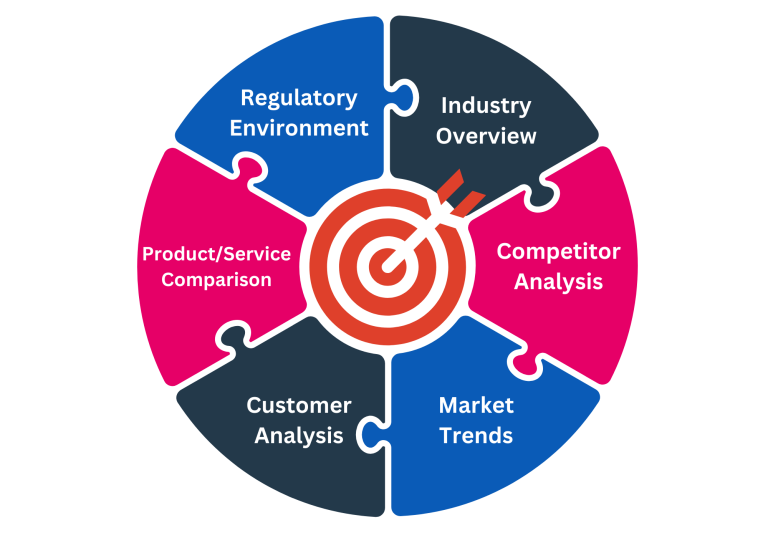

Industry trends and competitive landscape

The move to build an ad network aligns with a broader trend where companies with vast customer data, like PayPal, are entering the advertising space.

In the first quarter, it processed 6.5 billion payments from approximately 400 million customers. This wealth of data positions PayPal to offer highly targeted advertising solutions.

Other financial companies are following suit. Recently, JP Morgan Chase (NYSE: JPM) announced it would allow advertisers to target users of its website and banking app based on their transactional histories, reflecting a growing trend among financial services firms to create new revenue streams through advertising.

Under the leadership of Alex Chriss, PayPal’s CEO, since September, the company is refocusing on its strengths and areas where it has the highest potential for success.

To bolster its efforts, PayPal has also hired John Anderson, formerly of Plaid, to lead its consumer group. Anderson oversees product strategy for both PayPal and Venmo, enhancing the company’s overall market approach.

Impact on stock prices

The announcement of PayPal’s new advertising business has had a positive impact on its stock prices.

Shares of PayPal saw a 1.4% increase in premarket trading on Tuesday following the announcement.

The moves come as it shares are down about 80% from their July 2021 peak.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!