Lido (LDO) is a multi-platform staking solution that allows users to access the benefits of staking their crypto without fully locking their tokens.

In Proof of Stake (PoS) networks, users can lock their digital assets through staking to participate in the consensus process and continue adding blocks to the blockchain. Users may be penalized with a removal of a portion of their locked funds if they behave maliciously. This design effectively pulls a large amount of crypto out of the liquid market, potentially increasing the asset’s volatility and preventing stakers from participating in Web3 applications (like gaming, decentralized finance (DeFi), and NFTs) with their staked capital. In exchange for locking their funds and maintaining the blockchain, stakers earn rewards from the network.

But what if staked tokens weren’t fully “locked” and could be used in decentralized applications (dapps)? That is the basis for Lido, a liquid staking solution that operates on smart contract PoS blockchains like Ethereum, Polygon, Solana, and Polkadot. When a user stakes ETH through Lido (rather than directly through the Ethereum blockchain), they receive stETH (staked ETH) tokens in return which are not locked and are freely transferable.

This stETH can then be used to generate rewards in DeFi protocols like Curve and Aave, or for trading on decentralized exchanges like Uniswap. At the same time, it generates steady reward, like staking directly to the Ethereum blockchain. In short: Lido gives users the ability to benefit from staking by earning rewards (less a 10% fee) while avoiding some of the restrictions accompanying traditional staking. Throughout 2022 and into 2023, approximately 30% of all ETH were staked through Lido.

Lido is managed by a decentralized autonomous organization (DAO), which is made up of holders of its governance token: LDO. This token lets members of Lido’s community vote on proposals to add/change node operators and fees set by the service, among other things.

Table of Contents

Understanding Lido

Lido (LDO) was created to allow any user to trustlessly stake their ETH easily, no matter how much they have, in any amount. Lido doesn’t only make it easy to stake ETH and earn rewards, it also solves the problem of accessing the locked value when tokens are staked through a mechanism called Liquid Staking.

Lido makes it simple and convenient to stake and earn interest despite any technological hurdles. By staking with Lido your assets remain liquid and can be used across a range of DeFi applications, earning extra yield. Lido supports Ethereum and several top blockchains.

How was Lido developed?

Lido was introduced in October 2020 by Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish. Lomashuk is the founder and CEO of P2P Validator, a non-custodial staking service that was started in 2018 and by 2020 was managing over $4 billion in assets. Shapovalov works alongside Lomashuk as P2P Validator’s CTO. P2P Validator remains a main validator, developer, and operator of Lido.

Jordan Fish, known in the crypto community as “CryptoCobain” or, more commonly as “Cobie”, runs a popular crypto podcast and is an investor in the cryptocurrency space. He published the original introduction to Lido Finance on Medium and was involved in its development before leaving the project c. 2021.

Lido raised over $150 million since its inception, including $70 million in March 2022 from crypto investing giant Andreessen Horowitz.

How does Lido work?

Lido (LDO) offers a platform that allows users to stake as much or as little crypto as they want, regardless of the minimum threshold required by the blockchain.

For example, Ethereum validators must set up a node, which requires 32 ETH as well as technical hardware and know-how. This minimum amount can be hard for the average user to meet, and Lido’s liquid staking solution lowers the barrier to staking for many casual crypto users.

- an be a barrier for new or small investors.

- Lockup Periods: Staked tokens might be locked for a certain period, limiting your ability to access them freely.

- Technical Complexity: Running your own validator node can be complex and requires technical knowledge.

Lido acts as a middleman for staking cryptocurrencies on Proof-of-Stake (PoS) blockchains, making the process more accessible for users. Here’s a breakdown of how it works:

Traditional Staking vs Lido:

- Traditional Staking: On PoS blockchains like Ethereum 2.0, users can stake their tokens to validate transactions and earn rewards. However, it can be cumbersome:

- High Minimums: Blockchains often require a large minimum amount of tokens to be staked, shutting out smaller investors.

- Lockup Periods: Staked tokens might be locked for a specific time, limiting your ability to access them.

- Technical Complexity: Running your own validator node to participate in staking requires technical knowledge.

- Lido’s Solution: Liquid Staking Lido tackles these limitations by offering liquid staking:

- Lower Minimums: Stake any amount you have, regardless of the blockchain’s minimums.

- No Lockups: Lido provides liquid staking tokens (stTokens) representing your stake and rewards. You can trade or sell these stTokens freely.

- Simplified Process: Lido handles the complexities. You just deposit your tokens and receive stTokens

Staked Ethereum (stETH)

Although Lido (LDO) supports other chains, its flagship offering is liquid staking on Ethereum. When an Ethereum user stakes with Lido, they receive stETH in return.

This new ERC-20 token can be used like any other token on the Ethereum blockchain. For example, anyone can use their stETH to provide liquidity on the ETH/stETH pool on Curve or use the token as collateral to take out a loan on Aave.

When wishing to retrieve their Ethereum back from Lido, users can burn stETH and redeem the underlying ETH at any point in time.

While the prices of ETH and stETH are expected to be closely aligned, the two tokens are not formally “pegged.” This was especially evident during the collapses of both Terra and FTX in 2022 where the price of stETH dropped below ETH. However, in usual market conditions, arbitrageurs find small differences in the prices between stETH and ETH and trade between the two. This generates profits for traders while keeping the prices of the two assets relatively stable.

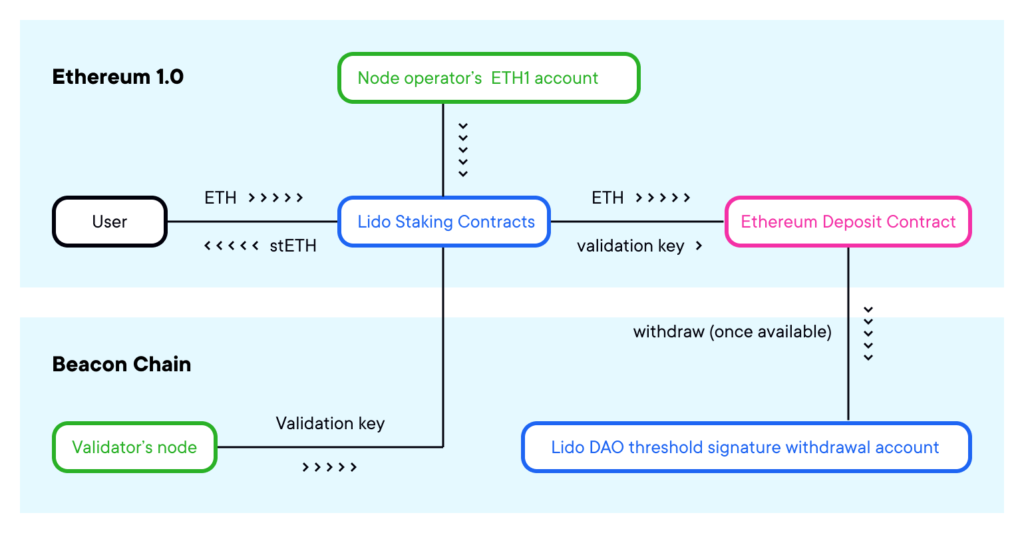

Backed by node operators

In order to formally stake the pooled assets from its depositors, Lido uses a core group of node operators. In the case of Ethereum, this means that Lido distributes users’ tokens in 32-ETH batches to all node validators. (In May 2023, there were 30 such validators.) The deposits and withdrawals of user funds are managed by smart contracts.

The Lido DAO is responsible for approving the nodes that power Lido, so these generally must be trusted entities with a history of good behavior as a validator. This reduces the risk of the validator being slashed (having its staked funds taken as a penalty), though this remains a risk to Lido users.

Lido charges a 10% fee on staking rewards, and these are split between node operators and the Lido DAO treasury.

What Makes Lido (LDO) Unique?

- Lido makes staking simple. Anyone can stake their digital assets to earn the rewards through Lido without minimum deposits and hardware setup and maintenance.

- Staked assets remain liquid and accessible. Unlike native staking, Lido lets users stake their assets without locking tokens as users receive stTokens in return, which can be swapped, traded, and transferred at any time. Furthermore, Lido’s stTokens have been integrated by a wide range of DeFi protocols on both Layer 1 and Layer 2 blockchains within the multi-chain ecosystem.

- Lido supports fast exit for unstaking. Unstaking in PoS protocols normally requires a waiting period which could be uncertain and see long delays which could be critical in times of market turmoil. Lido stakers are allowed to swap their stTokens to any other assets via secondary markets to fulfil a fast exit

What is Lido’s LDO token?

LDO is the governance token of Lido’s DAO, the decentralised body which carries out the governance decisions of the Lido community.

LDO is an ERC-20 token which gives holders governance rights and the ability to vote on improvement proposals, upgrades, and network parameters. The more LDO locked in a user’s voting contract, the greater the decision-making power the voter gets.

Lido’s DAO also manages the Lido DAO’s insurance and development funds, and the planned unbonding and withdrawals coming with Ethereum’s Shappella upgrade.

Lido (LDO) Tokenomics

- Token Symbol: LDO

- Total Supply: 1 billion

- Circulating Supply: 865,606,901 (except locked tokens and the tokens in Lido Dao Treasury)

- Contract address (Ethereum): 0x5a98fcbea516cf06857215779fd812ca3bef1b32

How is the LDO token used?

Owning LDO gives users the ability to vote on proposals to govern Lido through the Lido DAO. For example, the DAO adjudicates which users/entities can become validators for Lido, decides what fees Lido charges to operate, manages insurance and development funds, directs how to allocate the DAO’s treasury funds, and more.

One important way the DAO controls funds is through the Lido Ecosystem Grants Organization (LEGO), which supplies funding for Lido-based development efforts. One LEGO grant was the impetus behind implementing liquid staking on Solana, and many other grants have pushed Lido forward like this over the years.

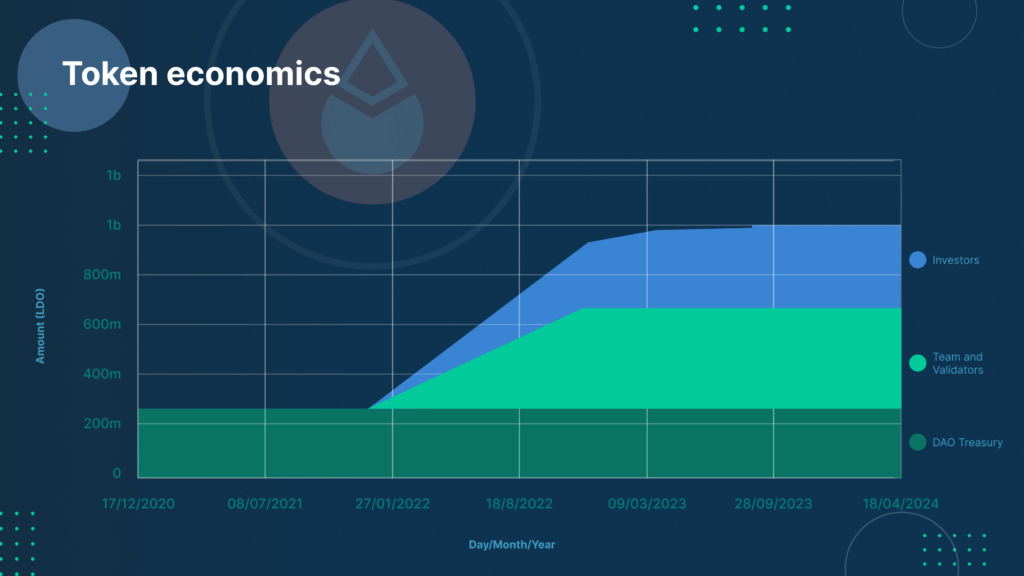

Token distribution

LDO was launched in January 2021, and it was announced that there was a total supply of 1 billion LDO tokens. At that time, 36.32% of all LDO were unlocked and available to use in the DAO treasury. Investors were allocated 22.18% of all LDO, 20% were given to Lido’s initial developers, 15% to founders and future employees, and 6.5% to validators and signature holders.

Lido essentials

- Lido (LDO) is a liquid staking solution that lowers the barrier for staking on multiple Proof of Stake blockchains—most notably, Ethereum.

- Throughout 2022 and into 2023, approximately 30% of all ETH were staked through Lido, which returns stETH to users as a liquid token to be used in DeFi, for trading, and other uses.

- LDO is Lido’s governance token, allowing holders to participate in decentralized governance of the platform.

The term “Lido essentials” can refer to a few different things depending on the context. Here are the two most likely interpretations:

- Lido’s Essential Features: This refers to the core functionalities that make Lido valuable for users. These essentials likely include:

- Low minimum stake amounts: You can stake any amount of supported tokens, bypassing high minimums required by some blockchains.

- Liquid staking: Receive stTokens representing your staked assets, allowing you to trade or sell them on DeFi platforms even while your original tokens are staked.

- Simplified staking process: No need to run validator nodes yourself. Lido handles the technical complexities, allowing you to easily participate in staking.

- Earning staking rewards: Automatically accumulate rewards on your staked assets through Lido.

- Getting Started with Lido: This interpretation focuses on the essential things you need to know before using Lido. This might include:

- Supported tokens: Lido allows staking for specific cryptocurrencies. Check which tokens are supported before you try to stake.

- Fees: Lido charges fees for its service, so be aware of the fee structure and how it impacts your potential returns.

- Understanding stTokens: Learn how stTokens work and how they represent your staked assets and accrued rewards.

- Security considerations: While Lido uses security measures, understand the inherent risks associated with DeFi platforms and smart contracts.

What are the possible risks when staking on Lido?

Lido may be one of the top liquidity staking protocols in the cryptocurrency space, but it is not without its own set of risks. Security threats and technical risks are inherent to the virtual space, so it’s always worth staying alert when dealing with service providers — even comparatively secure ones like Lido.

Some of the most significant risks that Lido users should be aware of are:

Technical risks related to the Beacon Chain

Ethereum’s PoS layer is relatively new and is still in its early days, during which all sorts of issues may become apparent. Even well-established networks may fall prey to technical risks given certain operational circumstances, and Ethereum’s development roadmap still has a long way to go. This opens it up to future technical risks that may affect its staking mechanism.

Smart contract bugs

This is not new information, but it bears repeating. All code-based platforms carry a bug-related risk that may compromise a network’s operations. Lido is assuredly open-sourced and regularly audited, though, plus it has a bounty program geared toward bug minimization.

DAO-related risks

Early on, Lido held collective assets of 600,000 ETH from multiple accounts. The protocol utilized multisignature thresholds, effectively reducing the risk of custody. Even with this security measure in place, there’s still a considerable danger that signatories get hacked or lose their keys. This can potentially lead to Lido’s funds being locked away indefinitely.

What is the Lido Ecosystem?

The Lido ecosystem is pretty nicely developed, as Lido has successfully made many important partnerships with some of the biggest names in the wider multi-chain Web3 ecosystem. Lido’s managed to successfully integrate stToken and LDO support into many wallets, layer 1 blockchains, Ethereum Layer 2 chains and protocols, DeFi protocols and platforms, Oracles, and Data Analytics tools.

To know more about this topic click here.

Lido Roadmap

The Lido development team and community are currently focused on Lido V2, Lido’s most ambitious network upgrade so far. Lido V2 will add compatibility with Ethereum’s Shapella upgrade which allows for withdrawals of staked ETH for the first time, as well as add “Staking Router” support.

- Withdrawals: This Lido on Ethereum protocol upgrade allows stETH holders to withdraw from Lido at a 1:1 ratio to unstake directly with Lido. This will be live in approximately May.

- Staking Router: Thanks to a new modular architectural design, anyone can develop on-ramps for new Node Operators, ranging from solo stakers, to DAOs and Distributed Validator Technology (DVT) clusters. Together they will create a more diverse validator ecosystem.

The Lido Team

Lido is a contributor-driven DAO with no centralised team. Initial contributors can be found here.

Notable Lido Partners

- Lido on Ethereum Node Operators: Certus.One, P2P Validator, Chorus, Stakefish, Staking Facilities, Blockscape, DSRV, Everstake, Kiln, RockX, Figment, Allnodes, Anyblock, Blockdaemon, Stakin, ChainLayer, Simply VC, BridgeTower, Stakely.io, InfStones, HashQuark, Codefi, SigmaPrime, Pragmatic Labs, ChainSafe, Nethermind, Kukis Global, CryptoManufaktur, RockLogic, Attestant.

- Lido on Polygon Node Operators: ShardLabs, DSRV, HashQuark, Kytzu, Girnaar Nodes, Matrix Stake.

- Lido on Solana Node Operators: Blockdaemon, Block Logic, Forbole, ChainLayer, RockX, Figment, Chorus, Stakefish, P2P Validator, DSRV, Everstake, Staking Fund, Chainode Tech, SyncNode, Stakewith.us, Stakin, Allnodes, Kiln, 01Node, H2O Nodes, Kukis Global.

How to buy LDO

You can buy the Lido coin on Bitstamp. Sign up for a Bitstamp account and start trading LDO today!

- Buy Lido (LDO) with Euro

- Buy Lido (LDO) with Dollar

Note: LDO is not available for trading in the US.

The future of Lido

Lido continues to dominate the DeFi scene as its total value of assets locked continues to increase, overtaking equally robust protocols like MakerDAO. This is in line with Ethereum’s shift to PoS and the network’s upcoming “Shanghai” upgrade.

Lido, alongside other liquid staking protocols, is expected to increase in strength as Ethereum pushes to open ETH withdrawals.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!