Today we will find an answer to the question “What is Terra Luna?” Luna is the native coin of Terra. The Korean company Terraform Labs created the LUNA blockchain. Through the private sale of Terra Luna coins, they raised $32 million to support this development. Investments were made from centralized sources like OKEx, Huobi, and Binance.

They launched the Terra Luna in 2019, and it was among the top decentralized financial coins for a while. Previously, CoinMarketCap ranked it the seventh-largest by market capitalization. However, on June 1, 2022, it occupied the 214th spot due to the recent crash.

Terra Luna serves four primary purposes in the Terra protocol:

- A way to pay transaction costs for its gas system (utility token).

- A method of participating in the platform’s governance structure. You can draft and vote on proposals that alter the Terra protocol by staking your LUNA tokens.

- A system to absorb changes in demand for stablecoins produced on Terra to keep price pegs.

- A token may be used to participate in the DPoS consensus system that allows validators to process network transactions.

One billion tokens are the maximum target supply for LUNA. Terra will burn LUNA until its supply equals its demand if the network hits one billion.

Table of Contents

How does Terra LUNA work?

The main objective of Terra blockchain was to create stablecoins. Stablecoins, are tokens intended to combine the decentralized freedom of cryptocurrencies with the stability of fiat money. LUNA was a crucial component of this system as a staking or protocol token.

Let’s say you want to mint 100 UST at the peg, or $100 in TerraUSD (UST). You must exchange an equivalent amount of money in LUNA tokens to mint the UST. Terra will burn the LUNA tokens you provide after that. Before the release of the Columbus-5 upgrade, Terra only burnt a fraction of the supplied tokens; now, 100% are burned. Thus, the algorithm would require you to burn 2 LUNA to produce 100 UST if LUNA were priced at $50 per coin.

Terra is one of the top three staking blockchains with over $30 billion in staked Luna tokens. Currently, the protocol is used to stake 41.54% of all Luna tokens. More than 15% of the total quantity of Luna tokens are held by Orion Money, the largest staking pool holding Luna.

What Problem Does Terra Solve?

Although the crypto industry’s adoption rate is swiftly increasing, the majority of people are reluctant to use cryptocurrencies as a medium of exchange because of the volatility. Sometimes, the prices of cryptocurrencies fluctuate around 10-20% within a day. Terra offers a price-stable digital currency ecosystem to solve this problem.

Terra has designed internal algorithms to maintain the stability of algorithmic stablecoins within its ecosystem. Terra USD (UST) is the main stablecoin of this platform that is backed by smart-contract algorithms and Luna token. This unique feature differentiates between UST and USDT because Terra doesn’t make any misleading claims about its reserves.

Terra has established a treasury that is similar to a central bank. This treasury manages the fiscal governance and spending regime of the platform.

History of the Terra blockchain

Terra was founded in 2018 by Do Kwon and Daniel Shin and launched its mainnet in 2019. Kwon and Shin built Terra to offer users the stability of fiat currencies while harnessing the power of blockchain technology for settlements that were faster and cheaper than traditional payment solutions. The two founders also believed that such options would increase blockchain adoption.

The Terra Alliance backs Terra. The Terra Alliance is a group of e-commerce businesses and platforms from around the world pushing for Terra adoption. Businesses within the Terra Alliance have a combined value worth tens of billions and more than 45 million customers across the companies.

What is the difference between LUNA 2.0 and LUNA Classic?

Despite their striking resemblance, LUNA Classic and LUNA 2.0 are not the same. The Terra network has been divided into two chains based on the new governance plan. Terra Classic with Luna Classic tokens (LUNC) will be the old chain, whereas Terra with LUNA tokens will be the new chain called LUNA 2.0.

The old LUNA will co-exist with LUNA 2.0 rather than being entirely replaced. Any decentralized applications (DApps) launched for Terra Luna will be favored for LUNA 2.0, and the development community will begin constructing DApps and providing utility for the new token. However, it does not include an algorithmic stablecoin.

However, this does not rule out the possibility of Terra Classic losing its community as many investors and traders oppose Do Kwon’s restoration plan and the new chain. In truth, Terra Classic retains a sizable following, and the classic community has agreed to begin burning as many LUNC tokens as possible to reduce the coin supply and raise individual token prices.

Understanding Terra Stablecoins

Terra’s stablecoins are a little bit similar to BUSD and DAI as they can be exchanged for an equivalent amount of fiat or other cryptocurrencies. However, Terra’s stablecoins are managed through algorithmic methods whereas the BUSD and DAI have to maintain US Dollars or Cryptocurrency reserves as collateral.

In Terra’s network, the stablecoins are backed by the utility token LUNA. The users can swap their stablecoins for LUNA whenever they want.

How Do Terra Stablecoins Work?

It’s already mentioned that the users need to mint their own TerraUSD coins by burning the equivalent amount of LUNA tokens. So, if LUNA’s price is $100 per coin and a user wants to mint 100 TerrraUSD coins, they’re required to burn 1 LUNA token. They can use the same process for minting LUNA tokens if they want to swap their TerraUSD for LUNA.

Thus, the price of TerraUSD remains stable because users are required to burn their UST tokens if they don’t need them anymore. The users need to pay 1 UST conversion fee for the minting process.

How the Value of Terra Stablecoins is Maintained?

Terra’s intended pegged value is $1. So, whenever the price drops below this level, arbitrageurs consider it an opportunity and they buy the UST from the exchange and then convert it to LUNA.

For example, if the price of UST drops to $0.98 per coin. The arbitrageur will buy 100 UST coins for $98 and they will convert it to LUNA because LUNA’s price is still $100 per coin. Thus, they can easily make a $2 profit from this simple trade. $2 may seem a bit small but when someone invests a huge amount, they can make massive profits in a safe way.

When a huge number of people start buying UST, the value of the coin gets back to $1 due to increased demand. Similarly, when the price of UST goes above $1, the arbitrageurs start converting their LUNA tokens into UST due to which the supply of the UST is increased and its value once again goes back to $1.

Thus, LUNA acts as collateral for Terra stablecoins while absorbing the volatility of the UST tokens.

The Rise and Collapse of Luna

Terra launched the Columbus-5 Mainnet upgrade on September 30, 2021, and on October 4, 2021, the LUNA coin price reached its first all-time high of $49.45. The Terra blockchain now includes a lot of additional features. For instance, it has facilitated and sped up the transfer of assets like UST to other blockchains. Terra can do this due to its integration with the Cosmos blockchain network.

Updates to the blockchain caused LUNA’s price to rise because the token’s value depended on Terra’s expansion. The coin’s debut price was $1.31 in July 2019. It was still below $10 a year later. However, LUNA’s value significantly increased toward the end of 2021, and on December 27, it reached its highest value of $103.33. LUNA defied the early 2022 market downturn by reaching a new all-time high of $119.18 on April 5. However, there was a sharp decline in price after that, and on May 6, 2022, the token’s price was $82.94.

The flaws in Terra’s ecosystem were exposed in May 2022. It resulted in a sharp fall in the price of LUNA. The broader cryptocurrency market was pessimistic then, with bitcoin falling to its lowest level in 10 months on May 10, 2022. The value of LUNA fell below $40 on the same day. The coin fell to its historic low on May 13 of $0.00001675. Terra’s stablecoin, which LUNA supports algorithmically, then lost its $1 peg. CoinMarketCap reports that on May 11, the price dropped to $0.29.

What Is Terra’s Mechanism Of Operation?

Consider purchasing a movie ticket, which is one of the most common things purchased through CHAI (one of Terra’s most popular decentralized programs, or dApps). To begin, you must first create your own Terra stablecoin on the website, burning the required number of LUNA tokens. You can use the CHAI mobile app to pay for your tickets online or in-store after your stablecoins.

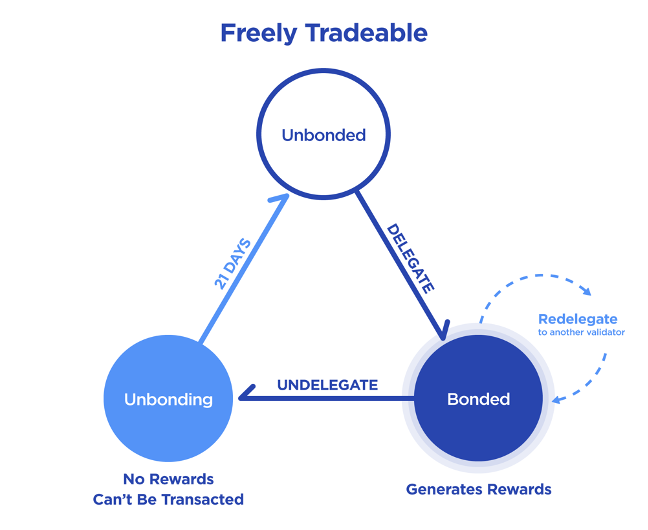

Terra’s blockchain creates a small transaction fee when you buy a ticket with your stablecoins, which is divided to LUNA delegators – token holders who choose to delegate their LUNA coin to a staking pool to safeguard the network. Terra is based on the Cosmos SDK and employs a delegated proof-of-stake consensus guaranteed by decentralized validators that resolve transactions for a fee. Validators and stakeholders can also vote in the network consensus, with voting power proportional to their stake allocated. The 130 active validators with the most LUNA tokens are picked to protect the network.

Terra Luna’s stablecoins are algorithmic stablecoins, which means that the protocol is built around algorithms to achieve price stability. The value of UST, for example, is equal to $1 USD and should remain consistent thanks to the LUNA token. When the UST supply falls below $1, Terra Luna increases the supply to keep the UST pegged to the dollar. Users who want to mint Terra stablecoins must burn a quantity of LUNA equal to one dollar. The community treasury receives a small fraction of the LUNA tokens used to mint stablecoins, known as seigniorage, making stablecoin minting beneficial for the network. It’s akin to the seigniorage that central banks earn from when they produce money.

Algorithmic stablecoins are a contentious stablecoin class that can be vulnerable to high price fluctuation. Smart-contract algorithms, financial engineering, and the market motivations of independent players ensure the pricing of algorithmic stablecoins – aspects that have proven unreliable in times of crises. This is a particular situation with Iron Finance’s bank run, when IRON, an algorithmic stablecoin, lost its peg and collapsed from US$1 to practically nothing in a single day owing to inadequate tokenomics, wiping away over US$1 billion in market worth.

LUNA Is Terra’s Native Token

Terra’s native currency, LUNA, is utilized for staking, governance, and collateral for the network’s algorithmic stablecoins. Holders of LUNA coins can stake their tokens to gain incentives and use their weight to vote on ecosystem governance initiatives. Terra Luna has a 1 billion coin supply that is constantly changing. If that quantity is exceeded, the protocol will automatically burn LUNA tokens.

At the time of writing, Terra Luna was the 9th-largest cryptocurrency by market capitalization, with a value of US$31.7 billion at the time of publication when the coin was trading for US$87.43. The token is critical to the ecosystem’s collateralizing process, which ensures that the price of Terra stablecoins remains stable.

The collateralization algorithm of Terra Luna is designed to have a dynamic supply that fluctuates according to the protocol. The question, how to buy a LUNA coin is quite common. In a nutshell, the stability of Terra stablecoins is ensured by LUNA and vice versa. The name of the protocol is meant to be a metaphor for the earth’s and moon’s symbiotic relationship and the way the two celestial entities provide gravitational stability to one another. Each Terra token is a crypto-collateralized, algorithmic stablecoin that is tethered to a fiat currency. TerraKRW (KRT), a stablecoin based on the South Korean won, was the company’s first stablecoin. TerraUSD (UST), TerraJPY, TerraCNY, TerraEUR, TerraGBP, and TerraSDR are among the others.

Terra’s Accomplishments

According to Terra Luna’s inventors, the system has a six-second average block time. All transactions on the Terra network are subject to gas fees, with each validator setting the minimum price. To preserve stability and combat foreign exchange arbitrage, extra fees are levied on top of the gas fees for transactions utilizing stablecoins.

The most frequent type of stablecoin fee is charged on all non-market swap stablecoin transactions and ranges from 0.1 percent to one percent, with a hard cap of one TerraSDT. Market trades involving stablecoins and Terra Luna are known as spread fees. Its minimum charge is fixed at 0.5 percent and is subject to change depending on market conditions. On-chain governance imposes a “Tobin fee” on market exchanges between stablecoins. The majority of market swaps will be subject to a.35 percent tax, with some stablecoin combinations having to pay as much as 2%.

Another important ecosystem component is Terra’s CHAI payment app, which aspires to be as frictionless as existing mainstream payment apps. Terra Bridge, a cross-chain technology that facilitates asset transfers between Terra, Binance Smart Chain, and Ethereum, also addresses interoperability. According to the creators, Terra stablecoins are also on the way to Solana. Mirror and Anchor are two other projects that contribute to the ecosystem.

Mirror Finance allows users to build synthetic assets, known as mAssets, that mimic stock prices to allow UST holders to obtain exposure to equities. The Shuttle bridge from Mirror also allows for mAsset swaps on the Ethereum network, making the ecosystem more interoperable. The Anchor Protocol is a cryptocurrency that allows users to receive fixed interest rates. Users do not need to find their own liquidity pools because crypto put on the protocol is automatically staked to a proof-of-stake blockchain network.

Concerns Regarding Terra Luna

DeFi is a tough market, and no platform is flawless, especially for early-stage companies like Terra Luna. Terra has a long way to go before catching up to leading DeFi chains like Ethereum and Binance Smart Chain. Terra stablecoins are also catching momentum, albeit they are losing ground to Tether’s USDT, the most popular stablecoin at the moment. Blockchain purists mostly criticize terra for being less decentralized than other networks. The Ethereum network’s 3,038 validators vastly outnumber its 130 validators. Another source of concern concerning decentralization is because the top ten network validators control roughly 40% of the delegated Terra Luna supply.

Finally, Terraform Labs has served a subpoena relating to the Mirror protocol as part of a Securities and Exchange Commission investigation into suspected securities law breaches such as unregistered brokerages and securities sales outside of regulated securities exchanges.

Use Cases of Terra Luna Token

With a circulating supply of 372 million coins, LUNA is the seventh-largest cryptocurrency in terms of market cap. It has a maximum supply of 1 Billion coins. The Terra network will burn the LUNA tokens to maintain the level if the supply ever went beyond the maximum limit. Terra Luna plays four roles on the Terra network.

Gas Fee – When a user processes a transaction on the Terra network, they need to pay a partial amount of LUNA tokens as a gas fee.

Staking – LUNA token holders can stake their tokens to act as validators. The staked tokens are also used to maintain the volatility of stablecoins.

Governance – LUNA token holders have the right to vote or create proposals for the growth of the platform.

Collateral – LUNA acts as collateral for stablecoins by absorbing their volatility.

Conclusion

In the future, Terra users will have several chances to gain profit from its cross-chain connectivity with other Cosmos SDK blockchains. In addition, Terra has space to expand and enhance its user base outside of Asia because the stablecoin subject is significant internationally in terms of legislation and mainstream usage in payment systems.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!