Jamie Dimon, CEO of JPMorgan (NYSE: JPM), warned that issues may arise in the private credit sector, especially as retail clients gain access to this rapidly growing asset class.

Speaking at an industry conference, he emphasized the risks involved, noting that retail clients often react strongly during financial difficulties.

Table of Contents

Who Was J.P. Morgan?

When John Pierpont Morgan arrived on Wall Street, it was a disorganized jumble of competing interests and one of the many financial centers in a country.

When he left Wall Street, it was a tightly knit group of big businesses leading one of the fastest-growing economies in the world. Much of the progress Wall Street experienced at the close of the 19th century and the beginning of the 20th was due to the influence of J.P. Morgan and the skill with which he wielded it.

Early Life and Education

When Morgan was born on April 17, 1837, in Hartford, Conn., there was very little doubt his future lay in banking. His father, Junius Spencer Morgan, was a partner in a bank run by another American, George Peabody.

Morgan was brought up knowing he would take his father’s place, and was trained for a career in banking. When the family moved to London, J.P. Morgan was sent to study in Switzerland and later in Germany.

Upon his retirement, George Peabody left the bank completely in the hands of Junius, even removing his name from it. J.S. Morgan & Co., the first Morgan bank, had made its debut. By this time, J.P. Morgan had finished his European education and was learning his future trade as his father’s New York agent while his father tended the more important London end of the business.

Morgan began to take over his father’s responsibilities following the Drexel-Morgan merger. The Drexel-Morgan merger extended the scope of the business, strengthened international ties, and added to the capital the bank was able to loan.

As his father faded to the background, Morgan took an increasing role in underwriting companies for public offerings. He took a great interest in the railroad, holding shares, handling offerings, financing, and even placing Morgan employees on the company boards. With the importance of the railroad growing throughout the continent, Morgan picked an excellent time to expand both his bank’s wealth and his personal power.

What is JPMorgan Chase?

JPMorgan Chase, officially JPMorgan Chase & Co., is a giant American multinational financial services company headquartered in New York City [US]. It’s the biggest bank in the United States by assets and also the world’s leader in terms of market capitalization [investment term, basically the total value of a company’s stock]. They offer a wide range of financial services, including:

- Investment banking: helping companies with mergers and acquisitions, raising capital, etc.

- Commercial banking: providing loans and other financial services to businesses

- Retail banking: serving individual customers through their Chase brand, offering accounts, credit cards, etc.

- Asset management: investing money on behalf of clients

JPMorgan Chase is a very influential company, and their health is considered important to the overall stability of the financial system.

Concerns Over Market Stability

JPMorgan CEO’s warnings come amid signs of potential instability in the private credit market. Former Apollo partner Sachin Khajuria, now running the family office firm Achilles Management, recently noted cracks forming in direct lending due to the influx of money.

Furthermore, Moody’s downgraded its outlook on direct lending funds linked to major fund managers such as BlackRock (NYSE: BLK), KKR & Co. (NYSE: KKR), and Oaktree Capital Management.

In his annual letter to shareholders, Dimon pointed out that the private credit industry has not yet faced a major downturn, which typically exposes the weaknesses of new financial products. He expressed surprise at some of the ratings given to private credit deals by agencies, comparing the situation to the mortgage market.

‘There could be good owners when you are a private proprietor, but not by the people who aren’t operating well, not good ones, those making mistakes. These people don’t understand credit scores, and there could be hell to pay,’ said Dimon.

Dimon recently weighed in on the worst-case scenario for the U.S. economy, saying, ‘I look at the range of outcomes, and again, the worst outcome for all of us is what you call stagflation, higher rates, and recession.’

Dimon’s cautionary remarks are a stark reminder of the potential risks of private credit. As this asset class becomes more accessible to retail clients, all stakeholders must be fully aware and cautious.

Competition and JPMorgan’s Strategy

JPMorgan, along with other banks, is facing stiff competition in the $1.7 trillion private credit industry, where giants like Apollo Global Management Inc. are handling increasingly larger deals. However, JPMorgan is not sitting idle.

The bank has earmarked over $10 billion from its own balance sheet for direct lending and is forming a co-lending partnership. Furthermore, its asset management division is actively seeking to acquire a private credit firm, as reported by Bloomberg. These strategic moves demonstrate JPMorgan’s commitment to maintaining its competitive edge.

Dimon highlighted that his firm aims to lead in lending practices and provide banking services to many key private credit firms. While he acknowledged that some players in the industry are brilliant, he cautioned that problems often stem from less competent participants.

JPMorgan Chase faces competition from several major players in the financial services industry. Here’s a breakdown of the competition and JPMorgan’s strategy to stay ahead:

Competitors:

- Traditional Banks: These include Bank of America, Wells Fargo, Citigroup, and regional banks. They compete with JPMorgan Chase in all areas, from consumer banking to investment banking.

- Fintech Companies: These are new, technology-driven companies that are offering innovative financial products and services. Examples include online banks, mobile payment apps, and robo-advisors. Fintech companies are particularly challenging JPMorgan Chase in areas like retail banking and wealth management.

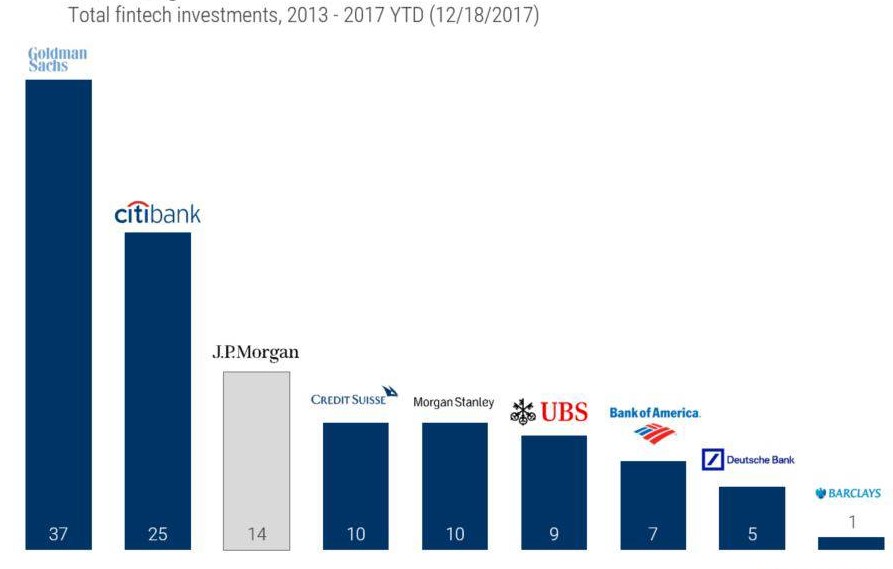

- Investment Banks: Firms like Goldman Sachs and Morgan Stanley compete with JPMorgan Chase in investment banking and trading activities.

JPMorgan’s Strategy:

- Diversification: JPMorgan Chase offers a wide range of financial services, which helps them to reduce their reliance on any one market or product.

- Scale and Efficiency: Being the biggest bank allows them to leverage economies of scale and invest heavily in technology to improve efficiency.

- Innovation: JPMorgan Chase is constantly innovating and developing new products and services to meet the changing needs of their customers. They are also investing in fintech themselves.

- Global Presence: JPMorgan Chase has a strong global presence, which allows them to tap into new markets and growth opportunities.

- Focus on Client Relationships: Building strong relationships with their clients is a core part of JPMorgan Chase’s strategy. They aim to be a trusted advisor to their clients across all their financial needs.

By focusing on these areas, JPMorgan Chase is trying to maintain its position as a leading financial services company in a competitive and changing environment.

Impactful Warning from JPMorgan’s CEO

JPMorgan CEO, Jamie Dimon, has sounded the alarm on the private credit industry, cautioning about the grave implications of deteriorating conditions. Dimon’s recent remarks have highlighted the urgent need for increased scrutiny and regulatory oversight in this sector.

JPMorgan Chase’s CEO, Jamie Dimon, issued a warning in his annual shareholder letter (2023) about potential economic headwinds. Here’s a breakdown of the key points:

- Concerns: Dimon expressed worry about several factors that could create significant economic risks, potentially worse than any seen since World War II. These factors include:

- Geopolitical Events: The war in Ukraine, conflicts in the Middle East, and rising tensions between the US and China could disrupt supply chains, increase energy prices, and create overall instability.

- Inflation: While inflation has shown signs of cooling, it’s still above the Federal Reserve’s target. Dimon believes factors like high government spending and the need for investment in areas like green energy could keep inflation elevated.

- Political Polarization: Dimon expressed concern that political gridlock in the US could hinder the country’s ability to address these challenges effectively.

- Market Optimism vs. Dimon’s Caution: While the broader market seems to be pricing in a “soft landing” for the economy (meaning modest growth with declining inflation and interest rates), Dimon believes the chances of this are lower than many expect.

- JPMorgan Chase’s Preparation: Despite his concerns, Dimon remains optimistic about the US economy’s long-term resilience. However, JPMorgan Chase is taking steps to prepare for a range of potential economic scenarios.

Impact of the Warning:

- Increased Awareness: Dimon’s warning has grabbed headlines and sparked discussions about potential economic risks. It could lead to increased caution and preparation among businesses and investors.

- Market Volatility: The warning could contribute to some market volatility, as investors weigh the potential risks against other economic factors.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this