The stock market is a complex beast, constantly influenced by a myriad of factors – economic data, interest rates, global events, and even investor sentiment. In an attempt to navigate this ever-shifting landscape, investors often turn to Wall Street banks for guidance. These financial institutions employ teams of analysts who spend their days dissecting economic trends and formulating predictions. While not guarantees, bank outlooks offer valuable insights into the potential direction of the market.

Between their sheer size, importance to the overall economy, influence on monetary policy, and over regional Federal Reserve Banks, major banks remain incredibly important players in both American and global markets.

Additionally, the veritable armies of experts and analysts they employ, as well as the wealth of information they can access that is hard to come by for regular investors, make their insights into what the stock market might do invaluable.

With these important factors in mind, Finbold decided to take a look into what U.S. banks believe 2024 has in store for the economy and where they are likely to invest their assets.

On January 3, 2024, the event-driven stock trader Gurgavin Chandhoke shared on X the overall principles each of the major banks believes will be relevant throughout this year.

Table of Contents

Defensive but optimistic

Barclays has a preference for large-cap stocks and prefers value investing over growth investing. It appears averse to exposure to international sales while preferring exposure to real rates and quality while attempting to hedge itself against possible market shocks.

According to BlackRock (NYSE: BLK), investors are likely too hopeful about the possibility of rate cuts in 2024 and are likely to be disappointed, leading to possible market shocks. It is, however, optimistic about artificial intelligence (AI) and generally believes in the revenue resilience of the technology sector.

BNY Mellon (NYSE: BK) is also rather bullish on American stocks – particularly on the “Magnificent Seven” and the AI-focused parts of the technology sector. It generally sees the possibility that the current rally will broaden.

Goldman Sachs is another bank bullish on the AI boom and has a preference for companies with proven track records and for high dividend payers.

Wells Fargo shares a similar stance, favoring large caps and being less optimistic about other firms. The bank also favors a defensive stance with investments in industrials, materials, and health care while avoiding sectors such as real estate.

UBS is also favorable toward quality companies and the tech sector and is keen to invest in emerging markets. The bank, however, sees the UK as the least preferred.

A more adventurous outlook

Fidelity is a bit of an outlier as it shows a preference for mid-cap stocks and the S&P 500 index – but not for the “Magnificent Seven” – and warns that small-cap firms might still be facing significant challenges in 2024.

Unlike many other major institutions, Charles Schwab (NYSE: SCHW) is more bullish on international than on U.S. stocks and believes that the momentum of shares of major firms – including the “Magnificent Seven” – will depend on the pace of interest rate cuts. It does, however, see significant growth potential when it comes to AI stocks.

Citigroup (NYSE: C) also believes that the rally will continue into 2024 and warns investors they should track indicators such as the lower gold and copper ratio and higher credit spreads if they want to gauge if the landing will be soft or hard.

Plenty of room for caution in 2024

Despite the optimism surrounding both the stock and the crypto market, several major banks remain highly cautious about how 2024 might look for investors.

Deutsche Bank is generally neutral but notably overweight on consumer cyclicals and financials. Morgan Stanley (NYSE: MS) largely believes that international markets will disappoint, that the U.S. will be strong only in the second half of the year and that Japan might prove to be a leader when it comes to equities in 2024.

HSBC shares a similar view on Japan but points out that U.S. equities are likely to face challenges. Finally, JP Morgan Chase (NYSE: JPM) is generally cautious, foreseeing middling earnings growth, and warns that the current geopolitical instability is significantly impacting its stock outlook.

A Bullish Undercurrent: The Optimistic View

Several major banks have adopted a bullish stance on the 2024 stock market, anticipating moderate to strong growth. Here are some key arguments underpinning their optimism:

- Cooling Inflation: Inflation, a major concern in 2023, is projected to show significant signs of abating in 2024. Banks like Goldman Sachs point to recent economic data suggesting inflation nearing the Federal Reserve’s target of 2%. This would ease pressure on interest rates and provide a more favorable environment for businesses and stock prices.

- Corporate Profit Growth: Despite a potential economic slowdown, analysts expect healthy corporate profit growth in 2024. Sectors like healthcare and technology are forecasted to lead the way, with earnings growth exceeding 10% for some companies. This translates to potentially higher stock valuations as investors reward companies with strong financial performance.

- Federal Reserve Pivot: The Federal Reserve’s monetary policy plays a crucial role in influencing the market. Many banks anticipate the Fed shifting towards a more dovish stance in 2024, potentially slowing down or even reversing interest rate hikes implemented in 2023. Lower interest rates make stocks a more attractive investment compared to bonds, potentially leading to increased investor appetite.

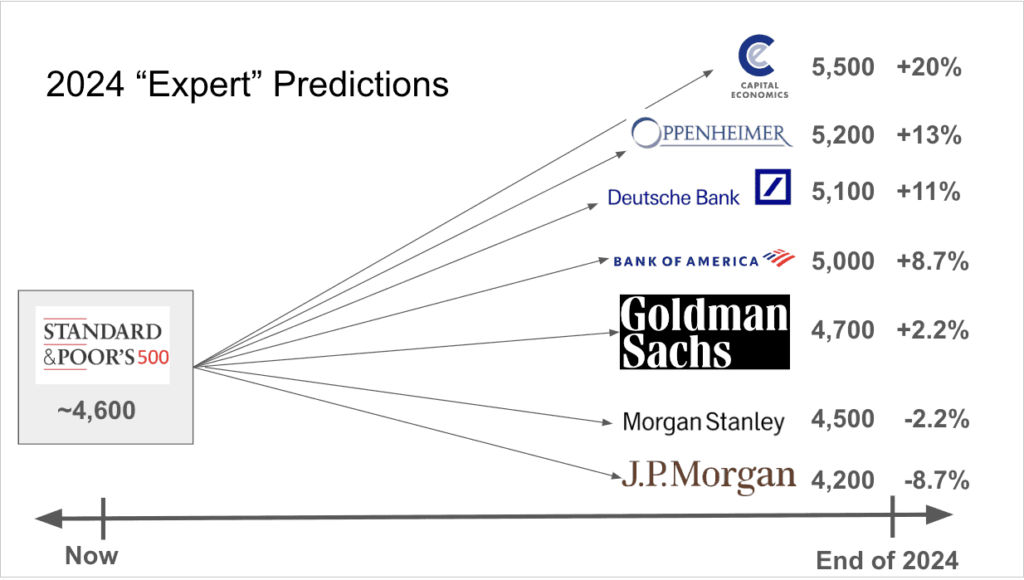

Specific Predictions

Banks translate their outlooks into specific projections for major market indices like the S&P 500. Here’s a glimpse into what some prominent institutions are forecasting:

- Goldman Sachs: Upgraded its 2024 S&P 500 target to 5,100, representing an anticipated 8% increase from current levels. This revision reflects their belief in a soft landing for the economy, where inflation cools without triggering a recession.

- Deutsche Bank: Echoes Goldman Sachs’ optimism, also setting a target of 5,100 for the S&P 500. They acknowledge a potential recession but believe it’s already priced into the market and wouldn’t significantly impact stock prices. In a best-case scenario where the economy avoids recession, they even predict a 19% gain for the S&P 500.

- LPL Financial: Leans towards large-cap growth stocks, anticipating they might outperform value stocks in 2024. They believe stabilizing interest rates and lower inflation could favor companies with strong future growth prospects.

Beyond the Bullish Narrative: A Word of Caution

While the overall sentiment from banks leans positive, there are reasons for investors to remain cautious:

- Geopolitical Tensions: Ongoing conflicts and international political instability can significantly disrupt global markets. The war in Ukraine serves as a stark reminder of how unforeseen events can trigger market volatility.

- The Fed Factor: The Federal Reserve’s actions hold immense power over the market. While a dovish pivot is anticipated, any unexpected changes in monetary policy could trigger a swift correction.

- Economic Slowdown: Even if a full-blown recession is avoided, a significant economic slowdown can still impact corporate profits and negatively affect stock prices.

What Investors Should Do

Bank predictions are valuable starting points, but they shouldn’t be the sole drivers of your investment decisions. Here are some additional steps you can take:

- Diversification is Key: Don’t put all your eggs in one basket. Spread your investments across different asset classes and sectors to mitigate risk.

- Consider Your Risk Tolerance: Are you comfortable with short-term volatility for potentially higher long-term gains? Tailor your investment strategy to your risk appetite.

- Do Your Own Research: Don’t blindly follow bank recommendations. Research individual companies and sectors before making investment decisions.

- Stay Informed: Keep up-to-date with economic data, geopolitical developments, and Federal Reserve actions.

The Bottom Line: A Year of Opportunity (with Caution)

2024 presents a year of potential growth for the stock market, fueled by factors like receding inflation and healthy corporate profits. However, this doesn’t mean it’ll be a smooth ride. Investors should be mindful of potential risks, diversify their portfolios, and conduct thorough research before making any investment decisions. Remember, bank predictions are just one piece of the puzzle.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this